Suzanne Berger is Raphael Dorman-Helen Starbuck Professor of Political Science. She co-chairs the new Production in the Innovation Economy project.

A summary from the book

OVER THE PAST decade, as close to 6 million manufacturing jobs disappeared, pessimism about the future of production swept across America. The brightest corporate superstars, like Apple, were locating production abroad and still reaping the lion's share of profits within the United States. Was this the model for the future? In emerging technology sectors, like batteries and solar and wind power, even when the start–ups were created in the United States out of U.S. innovations, commercialization of the technology was taking place abroad. What could Americans do to leverage their strengths in new science and technology to rebuild a dynamic economy? Would production capabilities at home be needed to capture the flow of benefits from invention and entrepreneurship? Which capabilities? And how could they be created and sustained?

THE MIT PRODUCTION IN THE INNOVATION ECONOMY PROJECT

At the end of the 1980s, MIT president Paul Gray had asked faculty members from across the Institute to analyze the causes of slow productivity growth in the United States. Made in America (1989) became a landmark in public debates about the U.S. economy.1 With that legacy in mind, MIT president Susan Hockfield in 2010 launched the MIT Production in the Innovation Economy (PIE) research group. Twenty faculty members and a dozen students joined. Its findings are reported in two recent books: Suzanne Berger and the MIT Production in the Innovation Economy Taskforce,Making in America: From Innovation to Market and Richard Locke and Rachel Wellhausen, editors, Production in the Innovation Economy. The objective was to analyze how innovation flows from ideas through production into the economy. Innovation is critical for economic growth and for a vibrant and productive society. The question was: What kinds of production do we need—and where do they need to be located—to sustain an innovative economy?

Making in America by Suzanne Berger

There are many reasons to worry about American manufacturing. Even though the U.S. share of world manufactured output has held fairly steady over the past decade, this reflects good results in only a few industrial sectors. In high–tech sectors the output of U.S. high–tech manufacturing is still the largest in the world but the U.S. share of this world market has been declining. Jobs are another huge concern. Manufacturing jobs were once especially valuable for workers and middle–class opportunity because they paid higher wages with better benefits than other jobs available to people with high–school education or less. National security is also linked to manufacturing through the procurement of new weapons and the maintenance and replacement parts for old equipment still in service. The disappearance of many suppliers creates greater dependence on foreign firms.

Across the entire industrial landscape there are gaping holes and missing pieces. Resources like training, collaboration between firms and universities, qualified suppliers, industrial consortia, and technical research centers are essential complements to the in–house capabilities of firms. The abundance of such resources distinguishes a fertile industrial ecosystem from a depleted and arid regional system. Today across much of the United States, small and medium–sized companies operate with only the resources they generate internally. Outside of such places as Silicon Valley, Austin, Texas, and Cambridge, Massachusetts, the industrial ecosystem cannot support the rate of innovation to market needed for a dynamic U.S. economy.

Over the past thirty years, national borders have opened to freer flows of ideas, goods, services, capital, and production. For many goods and services, international manufacturing contractors bring innovation into production. U.S. innovators have unprecedented opportunities to utilize production facilities that they do not have to build themselves. For the first time in the history of the industrial world, innovators in developing economies can connect with partners and suppliers at home and abroad and leap to niches close to the technological frontier.

But there are long–term risks in these relationships that go beyond the loss of proprietary knowledge and trade secrets. The danger is that as companies shift the commercialization of their technologies abroad, their capacity for initiating future rounds of innovation will be weakened. That's because much learning takes place as companies move their ideas beyond prototypes, demonstration, and pilot production into commercialization. Learning takes place as engineers and technicians on the factory floor come back with their problems to the design engineers and struggle with them to find better resolutions; as tacit knowledge is converted into standardized and codified processes; as end–users come back with complaints that need to be fixed. When production moves out, the terrain for future learning—and for profits and jobs—shrinks. Looking even further down the food chain beneath the companies to the laboratories that generate innovations in the first place, we saw reasons to fear that the loss of companies that can make things will end up in the loss of research that can invent them.

The PIE research basically asked one big question: what are the production capabilities here and abroad that contribute to sustaining innovation and realizing its benefits? We looked at innovation in products, in processes, in combinations of products and services; at innovation in start–ups, in large multinationals, in Main Street small and medium–sized manufacturers, in European and Asian partners and competitors, in hotspots for new technologies, like the biotech cluster of Cambridge, Massachusetts, in traditional manufacturing country, like Ohio, and in new manufacturing areas in the Southwest, in Arizona, in China, and in Germany.

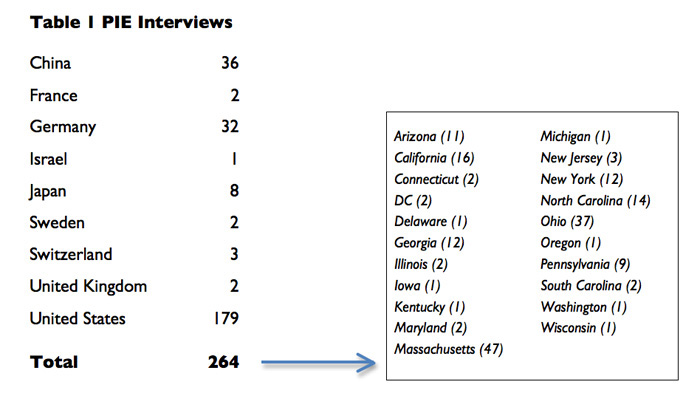

We tried to identify the processes by which innovation comes to market by tracing all the steps that a firm takes to procure the capital, labor, facilities, and expertise that are required to commercialize a new product and service. For this, we carried out much of the research in firm–level interviews. NSF statistics for 2006–8 report that 22 percent of all U.S. manufacturing firms had "a new or significantly improved product, service or process" but we really did not know what they were doing or how they were doing it.2 With the interviews and analyses we have now carried out, there is a clearer picture of what takes place within the black box of American manufacturing innovation and commercialization.

Even revolutionary technologies take long to commercialize. It took DuPont ten years to develop lab discoveries in polymers into full–scale nylon production in 1940. Today, as discoveries move along equally lengthy trajectories toward the market, we need to learn whether in–house manufacturing or manufacturing at a nearby contractor or manufacturing anywhere in the world does better or worse in accelerating the passage from lab to customer; whether ownership of manufacturing alters the distribution of benefits; and who learns what in the process and is in the best position to apply it to bringing the next discovery to life in the world. The interviews carried out in start–ups, Main Street manufacturers, and Fortune 500 companies, the skills survey of manufacturing establishments, and the scan of advanced manufacturing technologies that are on the near horizon have all informed the analysis and policy recommendations in the two PIE books.

THE GREAT TRANSFORMATION: THE NEW CORPORATE STRUCTURES OF THE AMERICAN ECONOMY AND THE ORIGINS OF THE PRODUCTION PROBLEM

From the 1980s on, the large corporations that had long dominated American manufacturing began to shed many of their business functions from R&D and design through detailed design to manufacturing and after–sales services.3 Financial markets pressed companies to focus on "core competences." By 2013 very few large American companies remain with vertically integrated structures. First among the business functions that companies moved out of their own corporate walls was manufacturing—because that produced reductions in headcount and in capital costs that stock markets immediately rewarded. Advances in digitization and modularity in the 1990s made it possible to carry out this strategy and to outsource production to manufacturing subcontractors like Flextronics and Jabil and eventually to foreign suppliers and contractors like Taiwan Semiconductor Manufacturing Company, Quanta, and Foxconn.

A more complete picture of the transformation of the global industrial landscape of the past thirty years would include developments outside the United States: dismantling border–level barriers to capital and trade flows; China's entry into WTO in 2001; the development of Hong Kong and Taiwanese–led supply chains with access to cheap semiskilled and skilled labor; new digital technologies that enabled the fragmentation of value chain; great new Asian consumer markets. But the starting point for understanding what happened to manufacturing in the United States, we believe, needs to be pushed back to the 1980s—well before Asian production and low–wage imports to the United States were significant. Out of finance–driven changes in the structures of big companies came some of the most difficult challenges we face today in trying to move U.S. innovation into the market.

- Vertically integrated enterprises had the resources to organize and pay for training much of the manufacturing workforce. Long job tenure meant companies could recover their investment in training over the course of an employee's career. Today, American manufacturing firms are on average smaller, and have fewer resources. They do not employ workers for life. They cannot afford to, or, in any event, do not, train. How do we educate the workforce we need?

- Vertically integrated enterprises like AT&T used to support long–term basic research in centers like Bell Labs. As corporate structures shrank, basic research was drastically cut, and these centers disappeared. Corporate R&D is now far more tightly linked to the near-term needs of the business units. When innovation grew out of large firms, they had the resources to scale up to mass commercialization. Today, when innovation emerges in start-ups or university or government labs, where does finance for scale–up come from beyond the initial years of venture funding?

Big American corporations in effect provided public goods through spillovers of research, training, diffusion of new technology to suppliers, and pressure on state and local governments to improve infrastructure. These spillovers constituted "complementary capabilities" that others could draw on, even if they had not contributed to creating them. As these "complementary capabilities" dried up, large holes in the industrial ecosystem have appeared.

The PIE research identified these holes in the industrial ecosystem—or market failures—as the single most challenging obstacle to creating and sustaining production capabilities in the United States that enable innovation to come to market. These gaps in the industrial ecosystem have been hollowed out by the disappearance of suppliers under pressure from global competition and by the disappearance of local capabilities that large corporations once provided as part of their own business operations. When new inputs are needed, like different skills, financing, and components, firms cannot efficiently produce all of them in–house. Even start–up companies with great novel technologies and generous venture backing cannot do it alone, we found. They need suppliers, qualified production workers and engineers, expertise beyond their own. Mid–sized manufacturers find little beyond their own internal resources when they develop new projects. They're "home alone." This environment is far different from that of the German manufacturers we interviewed, who are embedded in dense networks of trade associations, suppliers, technical schools, and applied research centers all within easy reach.

WHAT'S TO BE DONE?

The PIE research points to one urgent objective for U.S. policy: rebuilding the industrial ecosystem with capabilities that firms from multiple sectors could combine with their own when they try to bring new ideas into the market. The mechanisms through which these public goods could be created involve coordination among private and public actors. In such initiatives, a private company or a public institution performs a convening function. The initiative usually starts with the "convenor" putting new resources on the table for use by others on condition that they too contribute to the pot. One well∇known example is the SEMATECH Consortium that the semiconductor manufacturers and equipment makers formed in 1987 with financing initially from the federal government and today from industry and New York state. In Ohio, a company we studied was a convenor when it moved its coating laboratory and personnel into a local university and offered other companies the opportunity to use the facilities if they, too would contribute to its operation. New degree programs were also created at the university. We found cases in which a public intermediary provides coordination. In Springfield, Massachusetts, when a machining trade association faced a shortage of skilled workers as the result of the closing of large local companies that had previously trained apprentices, it approached the Regional Employment Board, which brought firms together with vocational high schools and community colleges to sponsor new training.

The first National Manufacturing Innovation Institute, the National Additive Manufacturing Innovation Institute (NAMII) in Youngstown, Ohio, offers companies, universities, and government agencies a way to distribute and reduce the risks of investing in 3D printing technologies. When gains from innovation are significant but distributed thinly across many firms, it's unlikely that any single one of them will invest enough to bring it to life. NAMII offers potential ways to induce collaboration and spread its risks.

Many cases of coordination we examined are recent, so we do not know which will work. If they have a real chance, it's because what's held manufacturing in the United States in the last resort—even as so much turned against it—was the advantage firms gain from proximity to innovation and proximity to users. Even in a world linked by big data and instant messaging, the gains from colocation have not disappeared. If we can learn from these ongoing experiments in linking innovation to production, new streams of growth can flow out of industrial America.

REFERENCES

1 Michael L. Dertouzos et al., Made in America: Regaining the Productive Edge(Cambridge, MA: MIT Press, 1989).

2 National Science Board, "Science and Engineering Indicators 2012."

3 See a fuller account of these changes in Suzanne Berger and MIT Industrial Performance Center, How We Compete: What Companies around the World Are Doing to Make It in Today's Global Economy (New York: Currency Doubleday, 2005).